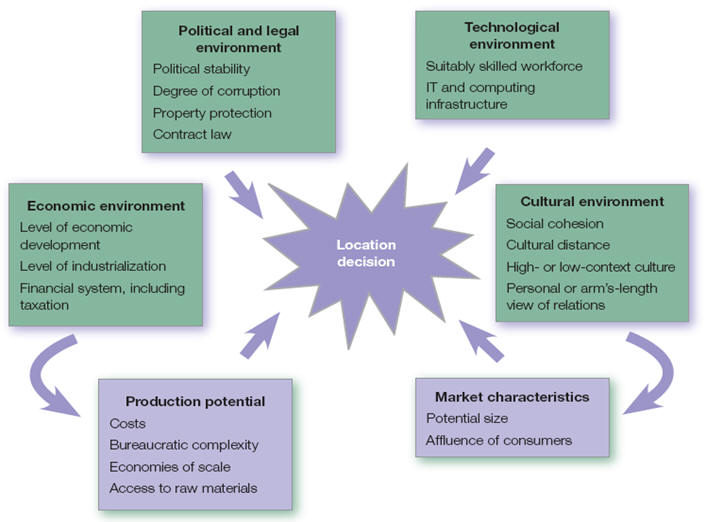

Attractions of

developing countries (page 247)

Assume that you are a

manufacturer of consumer products such as mobile phones. Choose a

developing country and assess its attractiveness as

|

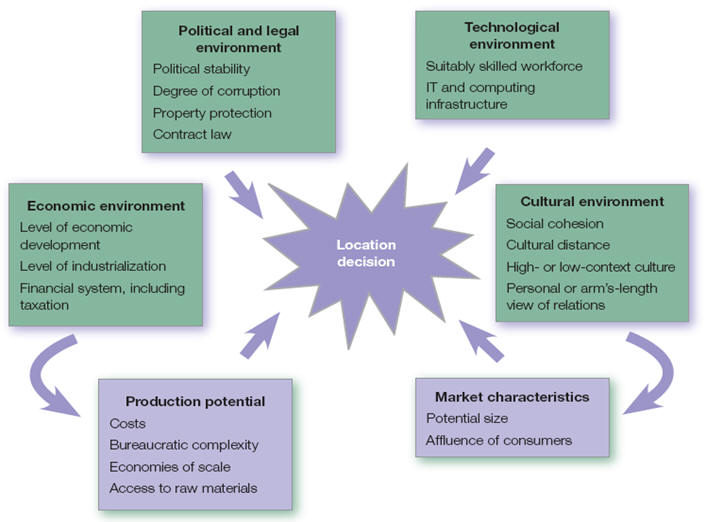

Whatever the country, the following points need to be covered.

|

Potential market for your products

-

Is there a growing middle class and

increasing demand for consumer products?

-

What competitors are in the country

already, serving the local market? Are these local or

global?

-

What hurdles are there at regulatory

level for the entry of new products?

|

|

|

Potential location for manufacturing your products |

-

Are there sufficient skilled workers

available for work in manufacturing?

-

Are transport and port facilities

adequate for your purposes?

-

Is economic development being managed

effectively, bringing a general rise in well-being in the

country?

-

Is there political stability in the

country? This need not imply that it is a democratic state,

but if there is an authoritarian government, is it one you

feel comfortable working with?

|

|

|

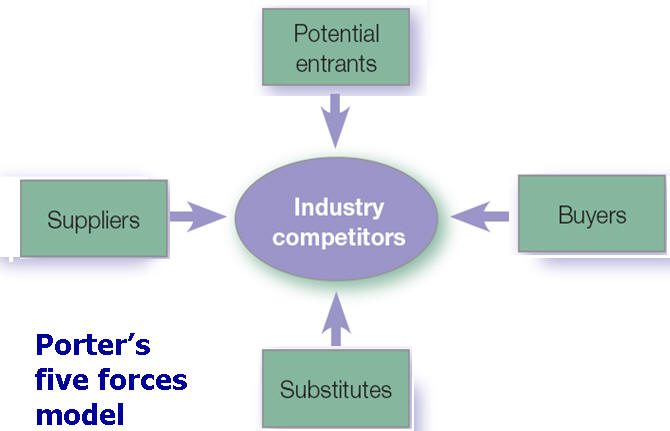

Porter and globalization

(page 249)

Critically assess Porter's view of

global competitive advantage in terms of center-subsidiary

relations. Do you agree with Porter's recommendations for global

corporate strategy, and why?

|

|

|

First, summarize how Porter

views competitive strategy globally. The MNE must choose the

best location for each aspect of its operations, depending on

the attributes of each country. Is he acknowledging the

importance of comparative advantage of differing countries?

Porter takes the view that the parent company determines global

strategy, and that subsidiaries in foreign locations exist to

serve the parent company’s goals, which include a fostering of

the company’s national identity. |

Many would probably disagree with this view of

parent-subsidiary relations, arguing that this is not the best way to

design a global corporate strategy. Possible reasons are:

-

Operations in a number of countries are bound

to be different in each, as each has its own cultural environment.

The parent company would be advised to accommodate and work within

the local culture, rather than impose its own culture, which might

be resented by local people.

-

The view of foreign subsidiaries looks rather

dated, as local subsidiaries are now more likely to be managed by

local people, rather than those sent from the parent company. Their

knowledge and skills in operating in the local environment equip

them to play a positive role in strategy formation, which can

ultimately aid the MNE parent’s executives.

|

Management implications of strategic

approaches (page 252)

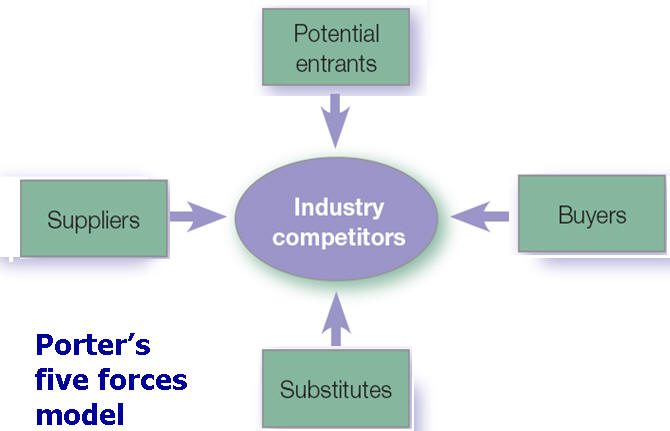

Assess the differing approaches of

Porter's five forces model and the resource-based models of

competitive advantage in terms of their management implications and

organizational culture?

|

Core competencies represent an organization's collective skill and

learning in its specialist areas. Competency and/or the resource-based

models of competitive advantage

|

•According

to this model, competencies…

-

•can

be applied to a variety of products,

-

•yield

benefits to the end product which reaches the consumer

-

•are

difficult for competitors to imitate

•The

strategic implications

are:

-

•clear

goals needed to sustain leadership

-

•outsourcing

and alliance strategies downplayed

|

|

Porter’s model envisages dominance of the parent

company, both organizationally and culturally. Managers rely on a strong

corporate culture as a source of unity, binding the parent with

subsidiaries in different countries. Local managers carry out

instructions of the head office. The resource-based models view the

parent company’s role more as one of co-ordination. For Prahalad and

Hamel, technologies and skills exist across the company, in different

locations and business units. Management’s role is to coordinate them,

building the company’s competencies. They stress the crucial role of

central management in maintaining the core competencies.

It is probable, but not necessary, that you will

agree with these criticisms, but the theory is still highly influential

and, with modifications, is useful for cross-country comparisons.

|

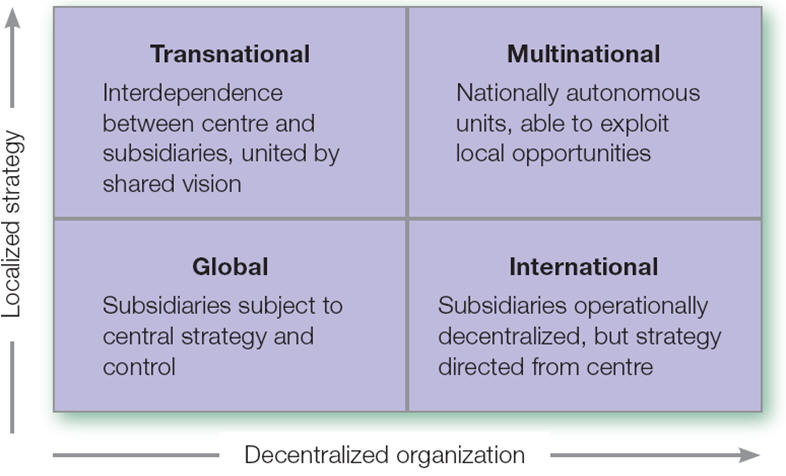

An ideal model?

(page 257)

Assess the advantages of the global organization described by

Bartlett and Ghoshal. Which model is best-suited to the following

MNEs, assuming each has a presence in Europe, the Americas and Asia:

|

Assess the advantages of the global organization compared to the

transnational organization described by Bartlett and Ghoshal. |

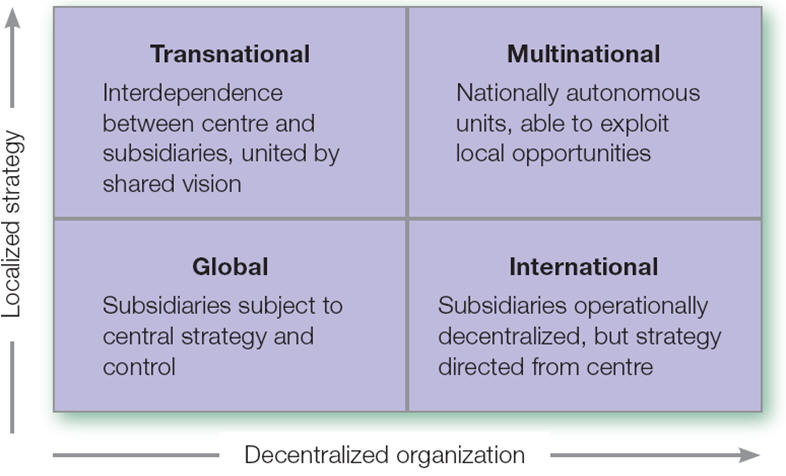

The Bartlett and Ghoshal typology highlights differences in

multi-divisional structures according to whether the :

|

|

|

The advantages of the global

organization rest with its centralized organization and control. This

type of company is not as vulnerable as decentralized companies to risks

in extended supply chains made up of different organizations, as it is

in a stronger position to control quality at each stage of production.

It is particularly suitable for mass-produced products with few local

variations.

Which model is best suited to specific MNEs?

Each of these MNEs is assumed to have a presence

in Europe, the Americas and Asia. There is probably no one best model

for each of these businesses. Much depends on cultural factors of the

national environment of the firm, and its historical background.

However, some recommendations can be made:

–

This company is likely to adopt the global model. Integration of

operations is needed, as is a global strategy. However, it should be

noted that oil companies operate in some difficult environments,

such as unstable developing countries, where managers must adapt to

local ways of doing things. Shell (featured in CS5.2) streamlined

its cumbersome organization in order to become more competitive. It

has also adapted to working in the difficult conditions in Nigeria.

A hypermarket retailer

– The

multinational model would probably be most appropriate. This is a

sector where local factors are important, and decentralized

organizations can respond to local needs and tastes. Distribution,

which is crucial in this sector, is typically handled by national

distribution networks, with which the retailer must work. It is

notable that Wal-Mart, which is closer to the global model, has

suffered setbacks in its internationalization from its strong

American base.

A television manufacturer

– This company

is likely to manufacture a range of consumer products in addition to

televisions. The transnational model is probably the best model.

This company is in a highly competitive sector, where the location

of production is crucial: companies seek proximity to large markets,

scale economies and cost reductions. Global strategy is needed, but

units bear considerable responsibility for management of operations.

A brewer

– Much consolidation has

occurred in the brewing industry. A few large companies, such as

AmBev, have grown by acquiring smaller brewers. The international

model or multinational model would be appropriate. The international

model is similar to a coordinated federation, with control from the

centre, but latitude for independent subsidiaries. The multinational

model is more decentralized, with more local autonomy and less

direction from the centre. Brewing is traditionally localized as a

business, emphasizing local brands and tastes. Although now

dominated by global companies, local markets remain important.

|

The flexible giant?

(Page 262)

The large MNE with dozens

of subsidiaries spanning all continents enjoys the advan-tage of

size, but its tendency towards bureaucracy and formal management may

be drawbacks to competitiveness. How can it use inter-organizational

networks to counterbalance these tendencies?

|

Inter-organizational networks can operate informally, cutting through

the procedural hurdles which are common in the large organization.

Interactions with other firms are central to managing supply-chain

links. The concept of the value chain has transformed international

production. The MNE becomes a co-ordinating organization, dealing with

firms in all stages of the supply chain. These links offer flexibility.

As they typically involve subcontractors, their services may be designed

for specific purposes and limited in time. The SME can play a role in

networks, offering specific specialist inputs which the large MNE may

lack. The networking approach is therefore flexible and adaptive.

However, the co-ordinating MNE must be vigilant to maintain core

competencies in-house. |

|

Inter-organizational networks

|

|

|

Click here to learn how De Beers control the world diamond market. |

Pop loses its fizz

(page 271)

Pop, a large MNE which manufactures soft

drinks and snacks, has found that its brands are being outsold by

rivals, including local brands, in many markets. It has always been

a highly centralized company, its product divisions designed for

global markets. Advise Pop's senior management on what changes you

would recommend in its strategy and organization, and how they

should implement them.

|

Strategy recommendations

-

Examine Pop’s portfolio of brands and products

critically. Which are the most successful in which markets?

Concentrate on the most successful and sell off the rest.

-

Examine the company’s markets. Which are

growing and which are stagnating? Emerging markets are now the

fastest growing, but they differ from country to country. In each,

local competitors will have established brands. Pop therefore needs

to target countries where its products and brands have the greatest

potential. Targeting individual markets implies adapting to local

preferences and designing marketing strategy accordingly.

-

Pop should evaluate its position in respect to

healthier alternatives to both its drinks and snacks, as these are

growing segments in all markets. Healthier snacks, with less salt

and fat, is a differentiation strategy which has potential and

offers consumers added value.

Organization recommendations

-

The global product divisions are proving

inflexible and unable to adapt to changing markets. The company

should consider regional divisions, with managers who can maximize

the potential of the products and brands in specific markets.

-

The company should probably decentralize

decision-making processes, to enable it to adapt to local

differences. The head office would maintain a co-ordinating role,

but responsibilities would be more shared than top-down.

How to go about implementing these changes?

These changes involve restructuring and changes in

roles and responsibilities. Such radical changes need to be managed from

the formal point of view, but they must be carried out with co-operation

of staff. This company has become accustomed to highly centralized

decision-making, and it will take time for staff to adjust to

decentralized responsibilities. Importantly, internal communication

needs to be more open, and communication with customers and other

stakeholders also needs to be improved. The centralized company tends to

be inward focused, which is partly why Pop has lost touch with markets.

|

What are the reasons behind the

success of Poland’s emerging MNEs since 1990?

First, highlight

the significance of Poland as a transition economy, including

liberalization, privatization and democracy. The changes have encouraged

business, including FDI. The reasons behind the success of Poland’s MNEs

since 1990:

-

Reduction in

red tape, bureaucracy and excessive regulation.

-

Growth in

numbers of entrepreneurs, as new opportunities emerged.

-

Desire of

start-ups to internationalize, attracted particularly by other

post-communist countries.

What tensions exist in the Polish social and political

environment?

Some which are highlighted in the case study:

-

Divide

between regions which have prospered from market reforms and those which

have not.

-

Large number

of unemployed people, and also a large number of people on state

benefits, including disability, unemployment and early retirement. The

generous system of welfare payments is a communist legacy, and

recipients are fearful that market reforms will cut back these programs.

-

Cultural

tension between traditional, nation-based values (associated with strong

Roman Catholic tradition) and more modern, secular values associated

with consumer market society.

-

Fragmented

political landscape, reflected in a wide range of parties. Shaky

coalition governments have become the norm, reflecting tensions between

parties which favor market reforms and conservative parties which are

skeptical of market reforms.

Asses the attractiveness of Poland as a destination for

FDI.

Poland is an

attractive destination for FDI despite significant drawbacks. The drawbacks

include bureaucracy and red tape. Poor infrastructure is also a problem.

Poland is a large country, and poor road and rail transport are obstacles

for investors. These drawbacks add to the costs of investing in Poland, but

if the attractions are overwhelming, they can compensate for the frustration

with procedures and infrastructure.

Poland’s

attractiveness stems from a number of features:

-

A strategic

location, well placed for serving Western European markets as well as

Central and Eastern European markets.

-

Large

population and rapidly-growing market for consumer goods and services.

-

Relative

political stability, despite political turmoil at party level.

-

GDP growth

rate has remained steady.

-

EU membership

from 2004 helped to encourage FDI (see Figure), and also promised

funding for infrastructure.

-

Government

led by the liberal Civic Platform Party under Donald Tusk is taking

steps to join the eurozone.

Assessing the overall picture, the potential investor would

probably agree that the advantages outweigh the drawbacks. But the

advantages depend partly on how future developments shape up, and how

competitive the location is in terms of costs for the potential investor.

Reducing bureaucratic red tape is urgent, as delays and administrative costs

reduce Poland’s attractiveness.

Weg Electric is competing in an industry, electric motors,

in which there are large, well-established global companies. As a Brazilian

company, it is an emerging MNE. Its main source of competitive advantage is

in its focus on customized products to suit customers’ needs. Also, it is

able to respond quickly to customers because it carries out most of its own

operations, including producing components. This strategy is one of

differentiation, offering a product and service which engenders customer

loyalty, making it less vulnerable to competition. Nonetheless, Weg has

internationalized, not so much to reduce costs as to be near to customers.

Its strength in R&D and training is possibly its most

important firm-based resource, because they feed directly into innovation

and product development. The company has not relied on outsourcing, and

therefore has greater control over manufacturing and sourcing than rival

companies, which are often caught up in disputes arising in managing these

relationships. Weg’s sense of self-reliance, part of its German cultural

heritage, is a firm-based resource and source of competitive advantage.