Responding to trends

in global trade

(page 205)

What trends are evident in

global trade, and how might the following players respond?

- An MNE in Europe

- The government of a

developing country

- An MNE in a developing

country

|

|

Developing and transitional countries are the new

emerging forces in global trade. Countries rich in natural resources are

benefiting from global demand. The countries of the developed world,

traditionally the major traders, are now becoming relatively less

influential as a more diverse picture emerges. In response to the three

examples:

-

An MNE from Europe

– This company

is likely to find that it is exporting more to emerging

markets,

but its home environment

is high-cost.

Because of globalized production, this

company is under

pressures to reduce costs and improve efficiency. It will be

considering production in a low-cost country, in order to export

from here to all markets.

|

Share of 2006 world

merchandise export

|

The government of a developing

country – This answer depends on the

trade profile of the country. If it is a poor sub-Saharan African

country dependent on agricultural commodities, the government will

try to encourage exports to rich countries, although they face trade

barriers. If it is rich in natural resources such as oil or gold,

exports can bring wealth to aid development, although in many

African countries, resource wealth has not yielded the development

that leaders had hoped for. Given appropriate conditions and

available workers, the government can attract export-oriented FDI,

in the hope that this will bring jobs and prosperity.

An MNE in a developing country

– The MNE may take advantage of the

increasing integration of developing countries in global trade. If

it is a manufacturer and its location is reasonably near good port

facilities, it can export to countries worldwide. It might also

consider FDI in another developing country, or a developed one, from

where it can serve new markets.

|

Trade and globalization

(page 209)

In what ways do the theories of trade

highlighted in this section explain processes of globalization? To

what extent do the divisions between winners and losers support

those who warn of the detrimental impacts of globalization?

|

Early theories of trade emphasized the importance

of location. This is true of the theory of comparative advantage and the

theory of factor endowments. These theories envisaged countries engaging

in trade to export goods in which they are more efficient producers, and

importing those in which they are less efficient. This view of how

countries behave is reflected in analysis of globalization, as firms

seek locations which allow them to produce most efficiently. Vernon’s

product life cycle similarly takes this view of country-specific

factors, with the added consideration of where FDI should be located.

Newer trade theories come to terms directly with globalized production

and economies of scale.

-

Trade theories highlight national gains from

trade and the effects of trade on different groups in society. Those

who warn of the detrimental impacts of globalization will find

evidence to support their views in these theories.

-

Low-cost countries which have built up

manufacturing of mass-market goods have benefited, and workers in

those industries, in particular, have seen wage rises. China is an

example. Losers have been workers in high-cost countries employed in

these same industries.

-

Poor developing countries which have neither

globally competitive industries nor natural resource wealth struggle

to maintain economic growth and prosperity. They are globalization’s

losers. They lack sufficient wealth to import the goods and services

they need, and risk falling behind in human development indicators.

-

Critics of globalization point to the widening

inequality in societies as well as the gap between the wealthier

emerging economies and the least-developed countries.

|

Assessing the theory of competitive

advantage

(page 211)

In what ways is Porter's theory an

advance on earlier international trade theories? What criticisms can

be leveled at the 'diamond' analysis, and to what extent do you feel

they are valid?

|

First, summarize Porter’s theory. Porter’s theory

looks at four specific aspects of a country’s environment, as well as

two other variables, including the role of governments. This is more

comprehensive than earlier theories, and therefore the theory of

competitive advantage presents a richer picture of the country.

Still, critics argue that Porter’s theory is too

limited, citing the following points:

|

|

-

The diamond of the company’s home country is

not as influential a determinant as Porter portrays. The national

diamonds of other countries where the MNE does business are equally

influential.

-

The role of government is underestimated.

-

Cultural environment is underestimated.

It is probable, but not necessary, that you will

agree with these criticisms, but the theory is still highly influential

and, with modifications, is useful for cross-country comparisons.

|

Do countries or

firms compete?

(page 212)

It is relatively easy to see how

firms compete, that is, by selling products in markets. How do

countries compete? With its booming economy and rising exports,

China is now an economic superpower, and China's firms are highly

competitive globally. Why, then, is China ranked relatively lowly in

competitiveness rankings?

|

How do countries compete?

Countries compete in terms of their business environment. The cultural,

political and legal environments of a country can be perceived as

favorable for business or disadvantageous. Government policies can

influence these aspects of the environment, for example, by fostering an

independent legal system. Often, a country presents a mixture of some

aspects which are advantageous and some which are potentially

detrimental. Choosing a location for FDI involves assessing these

country differences. In a world of footloose MNEs, governments typically

offer incentives to attract FDI. |

|

Why is China ranked comparatively low in the competitiveness

rankings?

-

Note the

criteria used by the organizations which publish rankings. China is

ranked lower in the WEF ranking, shown alongside, than in the IMD

one, although even in the IMD one it is only 15th.

-

Looking

at the criteria, government efficiency and economic prosperity are

two in which China is weaker than the more developed economies. The

still-vast rural population has enjoyed less of the prosperity and

improved well-being of the urban areas (and people here often rely

on remittances from migrant workers in urban areas).

-

See text

on p. 212 for WEF’s reasons for ranking China only 34th:

-

weak

institutions,

-

bureaucracy and

-

low

educational levels.

|

|

Bilateralism rules,

but who gains?

(page 220)

Why do bilateral agreements pose a

threat to the WTO and multilateralism? If the countries entering

these preferential agreements are happy to do so in their national

interest, why should there be any wider cause for concern?

|

Why do bilateral agreements pose a threat to the WTO and

multilateralism?

Countries which perceive that their interests are better served by

reaching bilateral trade agreements with trading partners are not as

motivated to devote effort towards multilateral agreements. As the main

international body promoting multilateralism, the WTO could be weakened

as a result. The piecemeal approach of both bilateral and regional

agreements represents a retreat from aims of the WTO, which were to

liberalize world trade. The WTO is a descendent of the post-war global

financial institutions

―

products of the aspiration towards global governance mechanisms. This

aspiration would be weakened by setbacks to the WTO.

If the countries entering these preferential agreements are happy to do

so in their national interest, why should there be any wider cause for

concern?

Many in the powerful countries such as the US

would probably argue that the proliferation of preferential trading

agreements is beneficial. However, there are causes for wider concern:

-

The spaghetti bowl of cross-cutting trade

agreements adversely affects MNEs, as legal complexities abound in

these agreements, and there may be several different relevant

agreements in cross-border activities.

-

These agreements are almost always lopsided,

favoring the stronger partner. The poorer country is likely to feel

pressurized into agreeing terms which are disadvantageous, in order

to gain some access to the richer country’s market. Some of these

terms may well impose other restrictions unrelated to trade.

|

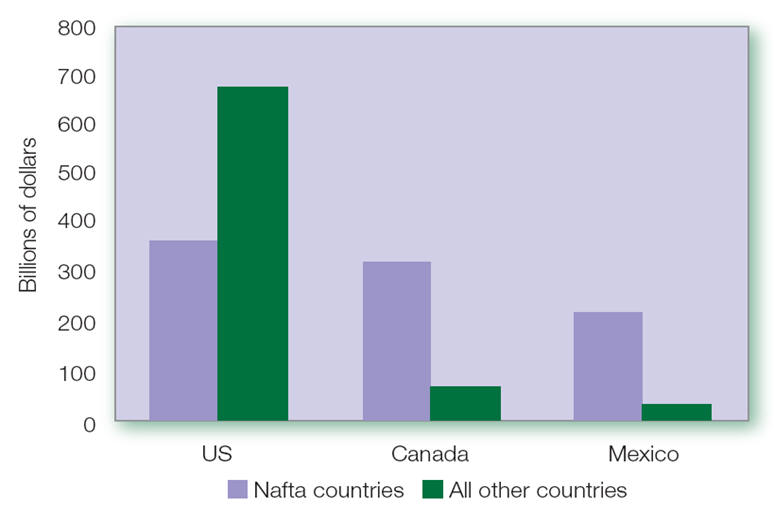

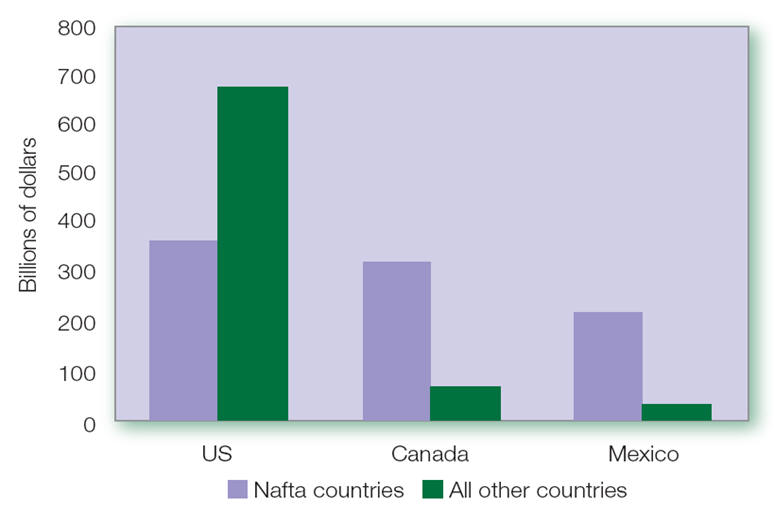

Beyond Nafta

(page 228)

Why is the Nafta model criticized within

the US and in the other member countries? What are the prospects for

future regional integration of the Americas?

|

Why is the Nafta model criticized within the US and in the other member

countries?

The Nafta model is a free-trade area, with the

removal of barriers to trade and cross-border investment between

members. Of the three members, the US is the regional superpower.

Both Mexico and Canada rely heavily on exports to

the US, but for the US, exports to the Nafta region are a little over

one-half of the exports to the non-Nafta countries.

Also, after 15 years of Nafta, Mexico remains a

poor developing country. There is much criticism of Nafta in the

US as well, as US jobs are alleged to have migrated to Mexico.

What are the prospects for future regional

integration of the Americas?

The US has aspired to lead a free trade area of

the Americas, but this has encountered obstacles, in that Venezuela and

Brazil, both significant exporters, have articulated their own interests

and goals, which would cause potential friction with US interests.

The US has looked to the Central American and

Caribbean countries to form a free trade area (Cafta). This is based on

a hub-and-spoke pattern, with the US at the hub. Cafta has been

criticized within the US by businesses fearful of cheap imports, and the

six poor countries which make up the ‘spokes’ are also fearful that they

will be vulnerable to agricultural imports from US agribusiness.

|

European economic integration

(page 230)

In

which respects has regional integration progressed significantly,

bringing benefits to EU citizens? In which respects has integration

been weak and why?

|

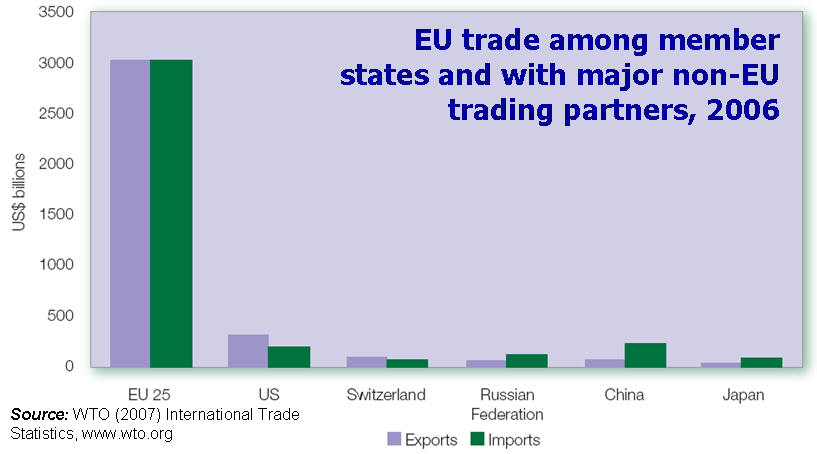

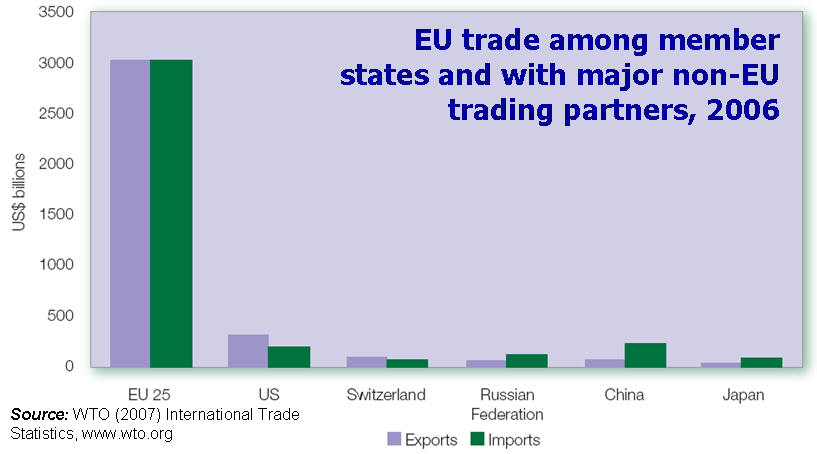

In which respects has regional integration progressed significantly,

bringing benefits to EU citizens?

The free movement of people among EU states has

been beneficial, although there have been some restrictions on people in

the newer member states who wish to work in EU 15 countries. Economic

integration is most marked in the euro-zone countries, as the single

currency has facilitated cross-border business. EU member states’ trade

is dominated by other member states (see Figure below).

In which respects has integration been weak and why?

Integration has been weaker in services across borders (e.g. financial

services) as regulation remains with national authorities.

|

See Figures 2 and

3. China imports fuel and other natural resources from African countries.

Its exports to Africa are manufactured goods. These include vehicles for

infrastructure projects, which are typically part of the trade deals which

China negotiates with African governments.