![]()

![]()

Updated on 05/05/2015

BusAd 175: Introduction to International Trade

Spring 2011

Course #3819

Apr 18 - Jun 8, 2011

Home My Book My Physical Geology Pages My Oceanography-115 class My Environmental Geology Pages

|

|

|

|

Updated on 05/05/2015 |

|

|

BusAd 175: Introduction to International Trade |

Spring 2011 Course #3819 Apr 18 - Jun 8, 2011 |

|||

|

Home My Book My Physical Geology Pages My Oceanography-115 class My Environmental Geology Pages |

||||

|

My BusAd classes: BusAd-101 (General Business), BusAd-170 (International Business), BusAd-175 (International Trade) BusAd-178 (International Finance) |

|

Chapter Outlines, Sample Tests and Review Questions |

|

|

|

|

Chapter 11: Methods of Payment |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Information and materials on this page are based on those provided by the author, Dr. Belay Seyoum Chapter Outline

Background

Methods of Payment

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

This is a documentary draft presented to buyer for payment of acceptance without being accompanied by shipping documents. |

|

||

|

This is a documentary draft accompanied by shipping documents. |

|||

|

||||

|

|

Documentary Letter of Credit (L/C): A document in which a bank or other financial institution assumes liability for payment of the purchase price to exporter on behalf of overseas customer. |

|

|

|

|

|||

|

|

|||

|

|

|

||

|

||||

Other Letters of Credit

|

|

|

|

||||

|

|

||||

|

This is a letter of credit whereby the

bank undertakes an obligation to pay at a future date stipulated

on the credit, provided that the terms and conditions of the

credit are met. |

|

|||

|

|

||||

|

|

|

True |

False |

||

| 1. |

In international business

transactions, banks are concerned with documents, not the merchandise. |

||

| 2. |

A disadvantage for companies

that insist on less risky transactions, such as a letter of credit, is that

they may be losing business to competitors who sell on open accounts. |

|

|

True |

False |

|||

|

Which of these payment methods could be risky for the seller: |

3. |

Cash in advance, because it requires the buyer to pay before shipment is effected. |

|||

| 4. |

Open account, because it requires payment to be made to the exporter within an agreed period of time. |

||||

| 5. |

Irrevocable letter

of credit,

because

it guarantees

payment to the seller. |

||||

|

True |

False |

||

|

6. |

|

|

In letters of credit, the buyer pays the issuing bank on or before the draft maturity date.

|

|

7. |

|

|

A confirmed letter of credit is preferred to a documentary draft because it guarantees payment to the seller.

|

|

|

True |

False |

|||

|

Letters of credit is a contractual relationship between ... |

8. |

|

|

Buyer and its bank |

|

|

9. |

|

|

Issuing bank and seller |

||

| 10. | Issuing bank and correspondent bank | ||||

|

|

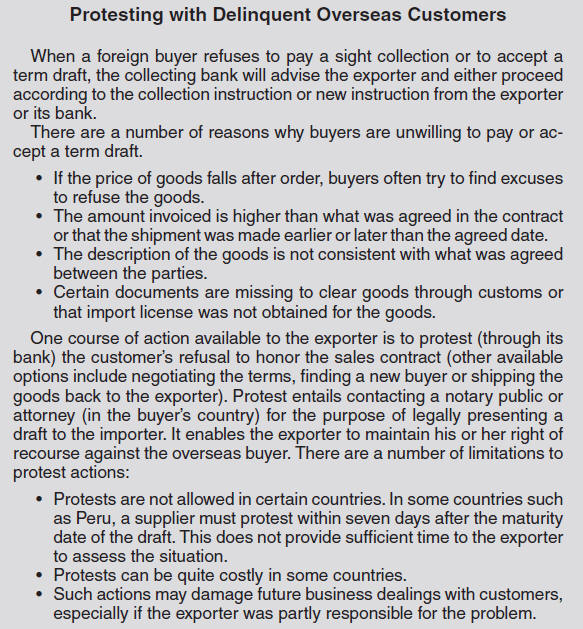

Discuss the distribution of risk in the following export payment terms: consignment, time draft.

Consignment, time draft, and revocable letter of credit (in that order) entail high risk to the exporter (less risk to overseas buyer).

What are the advantages and disadvantages of these payment terms: documentary collections, open account sales, revocable letters of credit?

Documentary collection advantages: bank fees are less expensive, seller retains title and control of shipment till payment is received or promissory note is given; disadvantage: buyer may refuse to pay or accept draft at maturity. Open account sales advantages: increases sales, helps test-market new products, buyer gets enough time to resell products; disadvantages: buyer could delay/default on payment. Revocable letter of credit advantages: Less costly, and is convenient for transactions between parent and subsidiaries as well as between firms who have done business over some time and trust each one another; disadvantages: issuing bank can cancel/amend credit at any time; seller’s bank does not confirm credit and hence no guarantee for seller as in irrevocable/confirmed L/C.

State the different steps involved in a confirmed documentary letter of credit, with payment terms of ninety days sight.

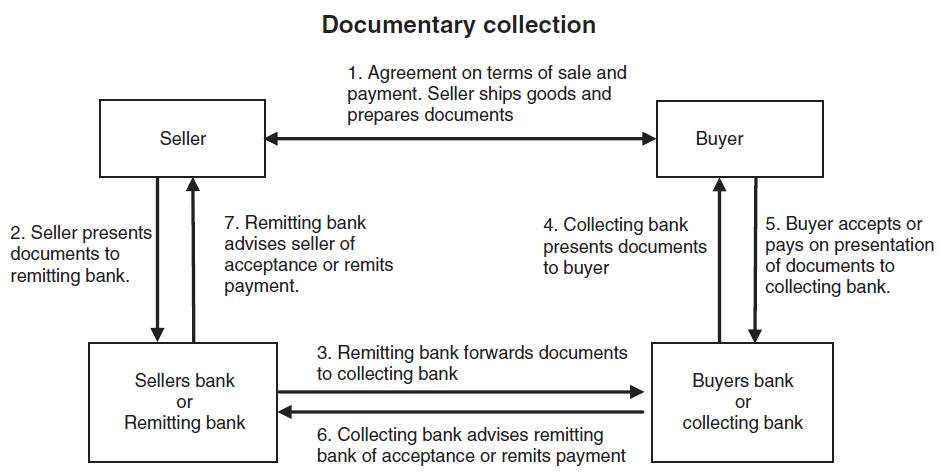

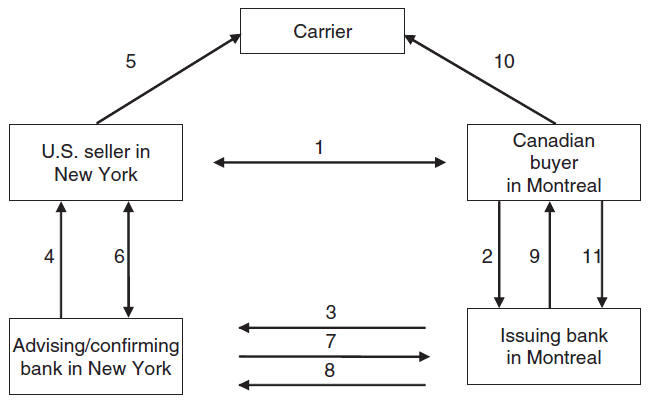

Consider the case of U.S. seller in New York and the Canadian buyer in Montreal. The following steps, also schematically illustrated below, are involved in letter of credit for this deal:

The Canadian buyer in Montreal contracts with the U.S. seller in New York. The agreement provides for the payment to be financed by means of a confirmed, irrevocable documentary credit for goods delivered CIF, port of Montreal.

The Canadian buyer applies to its bank (issuing bank), which issues the letter of credit with the U.S. seller as beneficiary.

|

|

After shipment of merchandise, the U.S. seller submits relevant documents to the advising/confirming bank for payment. If the documents comply, the advising/confirming bank will pay the seller. (If the L/C provides for acceptance, the bank accepts the draft, signifying its commitment to pay the face value at maturity to the seller or bona fide holder of the draft—acceptance L/C. It is straight L/C if payment is made by the issuing bank or the bank designated in the credit at a determinable future date. If the credit provides for negotiation at any bank, it is negotiable L/C.).

The advising/confirming bank sends documents plus settlement instructions to the issuing bank.

On inspecting documents for compliance with instructions, the issuing bank reimburses/remits proceeds to the advising/confirming bank.

The issuing bank gives documents to the buyer and presents the term draft for acceptance. With a sight draft, the issuing bank will be paid by the buyer on presentation of documents.

The buyer arranges for clearance of the merchandise, that is, gives up the bill of lading and takes receipt of goods.

The buyer pays the issuing bank on or before the draft maturity date.

Compare and contrast documentary collections and documentary letter of credit.

The manager of the letter of credit division of Citibank in Chicago learns that the ship on which a local exporter shipped goods to Yokahama, Japan, was destroyed by fire. He knows that the buyer in Yokahama will never receive the goods. The manager, however, received all the documents required under the letter of credit. Should the manager pay the exporter or withhold payment and notify the overseas customer in Japan?

The manager must pay the exporter if the latter has presented all the documents required under the letter of credit.

Compare the role and responsibility of banks in documentary collections and letters of credit.

Role of banks in documentary draft: verification of documents received and compliance with instructions in the collection order. Role of banks in documentary credit: honor the letter of credit if the documents comply with the terms of the credit, act equitably and in good faith.

What is the independent principle?

Independent principle: The letter of credit is separate from, and independent of, other contracts relating to the transaction.

Discuss the rule of strict compliance.

Rule of strict compliance: the exporter cannot compel payment by banks unless the documents presented strictly comply with the terms specified in the credit.

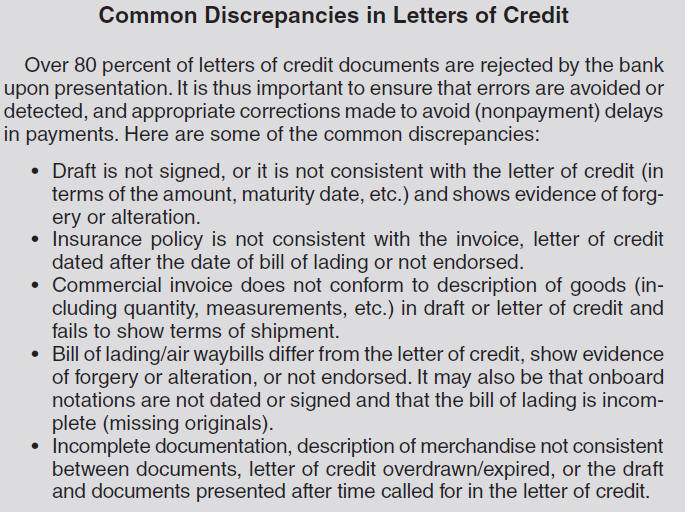

Provide an example of a major discrepancy in letters of credit.

Presentation of documents after the expiry date of the letter of credit, expiration of the letter of credit.

Briefly describe the following: transferable L/C, back-to-back L/C, deferred L/C, standby L/C.

Transferable letter of credit: permits a beneficiary to transfer the credit to a second beneficiaryBack-to-back credit: a letter of credit issued on the strength of another letter of credit.

Deferred letter of credit: seller agrees not to present a sight draft until after a specified period following presentation of documents. No draft need accompany the documents.

Standby letter of credit: a credit used to guarantee that a party will fulfill its obligation under a sales or service contract.