Page 103 - Fall 2021 GCC Class Schedule

P. 103

GCC SCHEDULE • FALL 2021 101

APCparolpimfloicirsanetiiaGonCraonlltege

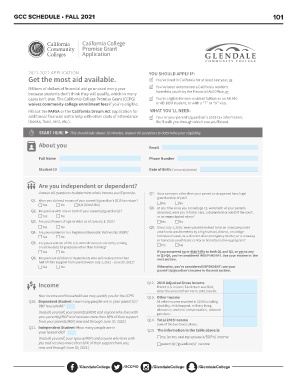

2021-2022 APPLICATION YOU SHOULD APPLY IF:

Get the most aid available. You’ve lived in California for at least one year, or

Millions of dollars of financial aid go unused every year You’ve been determined a California resident

because students don’t think they will qualify, which in many homeless youth by the Financial Aid Office, or

cases isn’t true. The California College Promise Grant (CCPG)

waives community college enrollment fees if you’re eligible. You’re eligible for non-resident tuition as an AB 540

Fill out the FAFSA or the California Dream Act application for or AB 1899 student, or with a “T” or “U” visa.

additional financial aid to help with other costs of attendance

(books, food, rent, etc.). WHAT YOU’LL NEED:

Your or your parent’s/guardian’s 2019 tax information.

We’ll walk you through which one you’ll need.

▶START HERE This should take about 10 minutes. Answer all questions to determine your eligibility.

About you Email

Full Name Phone Number

Student ID Date of Birth (Format 00/00/0000)

Are you independent or dependent? Q7. Does someone other than your parent or stepparent have legal

guardianship of you?

Answer all questions to determine who’s income you’ll provide. Yes No

Q1. Were you claimed on one of your parent’s/guardian’s 2019 tax return? Q8. At any time since you turned age 13, were both of your parents

Yes No N/A (Didn’t file) deceased, were you in foster care, a dependent or ward of the court,

or an emancipated minor?

Q2. Do you live with one or both of your parent(s)/guardian(s)? Yes No

Yes No

Q9. Since July 1, 2020, were you determined to be an unaccompanied

Q3. Are you 24 years of age or older as of January 1, 2021? youth who was homeless by a high school, district, or college

Yes No homeless liaison, or a director of an emergency shelter, or a runaway

or homeless youth basic center or transitional living program?

Q4. Are you married or in a Registered Domestic Partnership (RDP)? Yes No

Yes No

If you answered no or didn’t file to both Q1 and Q2, or yes to any

Q5. Are you a veteran of the U.S. Armed Forces or currently serving in Q3-Q9, you’re considered INDEPENDENT. Use your income in the

on active duty for purposes other than training? next section.

Yes No

Otherwise, you’re considered DEPENDENT: use your

Q6. Do you have children or dependents who will receive more than parent’(s)/guardian’s income in the next section.

half of their support from you between July 1, 2021 - June 30, 2022?

Yes No

Income Q12. 2019 Adjusted Gross Income

If 2019 U.S. Income Tax Return was filed,

Your income and household size may qualify you for the CCPG. enter the amount from Form 1040, line 8b.

Q10. Dependent Student: How many people are in your parent(s)’/

Q13. Other Income

RDP household? All other income received in 2019 including

(Include yourself, your parent(s)/RDP, and anyone who lives with disability, child support, military living

your parent(s)/RDP and receives more than 50% of their support allowance, workers’ compensation, untaxed

from your parents/RDP, now and through June 30, 2022.) pensions.

Q11. Independent Student: How many people are in

your household? Q14. Total 2019 Income

(Include yourself, your spouse/RDP, and anyone who lives with Sum of the two boxes above.

you and receives more than 50% of their support from you,

now and through June 30, 2022.) Q15. The information in the table above is:

my (or my and my spouse’s/RDP’s) income

parent(s)’/guardian(s)’ income

/GlendaleCollege /GCCPIO /GlendaleCollege /GlendaleCollege