Page 95 - Spring 2020 Class Schedule

P. 95

GCC SCHEDULE · FALL 2019 93 93

GCC SCHEDULE · SPRING 2020

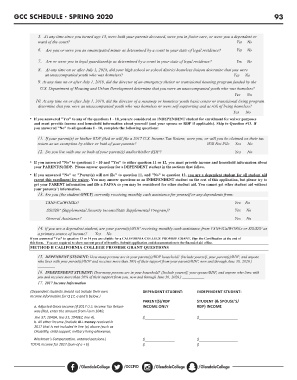

5. At any time since you turned age 13, were both your parents deceased, were you in foster care, or were you a dependent or

ward of the court? Yes No

6. Are you or were you an emancipated minor as determined by a court in your state of legal residence? Yes No

7. Are or were you in legal guardianship as determined by a court in your state of legal residence? Yes No

8. At any time on or after July 1, 2018, did your high school or school district homeless liaison determine that you were

an unaccompanied youth who was homeless? Yes No

9. At any time on or after July 1, 2018, did the director of an emergency shelter or transitional housing program funded by the

U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless?

Yes No

10. At any time on or after July 1, 2018, did the director of a runaway or homeless youth basic center or transitional living program

determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless?

Yes No

• If you answered "Yes" to any of the questions 1 - 10, you are considered an INDEPENDENT student for enrollment fee waiver purposes

and must provide income and household information about yourself (and your spouse or RDP if applicable). Skip to Question #13. If

you answered "No" to all questions 1 - 10, complete the following questions:

11. If your parent(s) or his/her RDP filed or will file a 2017 U.S. Income Tax Return, were you, or will you be claimed on their tax

return as an exemption by either or both of your parents? Will Not File Yes No

12. Do you live with one or both of your parent(s) and/orhis/her RDP? Yes No

• If you answered "No" to questions 1 - 10 and "Yes" to either question 11 or 12, you must provide income and household information about

your PARENT(S)/RDP. Please answer questions for a DEPENDENT student in the sections that follow.

• If you answered "No" or "Parent(s) will not file" to question 11, and "No" to question 12, you are a dependent student for all student aid

except this enrollment fee waiver. You may answer questions as an INDEPENDENT student on the rest of this application, but please try to

get your PARENT information and file a FAFSA so you may be considered for other student aid. You cannot get other student aid without

your parent(s’) information.

13. Are you (the student ONLY) currently receiving monthly cash assistance for yourself or any dependents from:

TANF/CalWORKs? Yes No

SSI/SSP (Supplemental Security Income/State Supplemental Program)? Yes No

General Assistance? Yes No

14. If you are a dependent student, are your parent(s)/RDP receiving monthly cash assistance from TANF/CalWORKs or SSI/SSP as

a primary source of income? Yes No

If you answered "Yes" to question 13 or 14 you are eligible for a CALIFORNIA COLLEGE PROMISE GRANT. Sign the Certification at the end of

this form. You are required to show current proof of benefits. Submit application and documentation to the financial aid office.

METHOD B CALIFORNIA COLLEGE PROMISE GRANT QUESTIONS

15. DEPENDENT STUDENT: How many persons are in your parent(s)/RDP household? (Include yourself, your parent(s)/RDP, and anyone

who lives with your parent(s)/RDP and receives more than 50% of their support from your parents/RDP, now and through June 30, 2020.)

16. INDEPENDENT STUDENT: How many persons are in your household? (Include yourself, your spouse/RDP, and anyone who lives with

you and receives more than 50% of their support from you, now and through June 30, 2020.)

17. 2017 Income Information

(Dependent students should not include their own DEPENDENT STUDENT: INDEPENDENT STUDENT:

Income information for Q 17, a and b below.)

PARENT(S)/RDP STUDENT (& SPOUSE’S/

a. Adjusted Gross Income (If 2017 U.S. Income Tax Return INCOME ONLY RDP) INCOME

was filed, enter the amount from Form 1040,

line 37; 1040A, line 21; 1040EZ, line 4). $ $

b. All other income (Include ALL money received in

2017 that is not included in line (a) above (such as

Disability, child support, military living allowance,

Workman’s Compensation, untaxed pensions.) $ $

TOTAL Income for 2017 (Sum of a + b) $ $

/GlendaleCollege

/GlendaleCollege /GCCPIO /GlendaleCollege /GlendaleCollege

/GlendaleCollege

/GlendaleCollege

/GCCPIO