|

|

to Poorna Pal's Pages at the

|

|

Busad-101: Sample Test 3 |

|

Updated on 05/05/2015

|

Home My Book My Physical Geology Pages My Oceanography-115 class |

|

|

|

|

||

|

|

|

Updated on 05/05/2015 |

||||

|

||||||

|

|

|

|

|

|

|

Microsoft Office is the example of a decision support system. |

|

|

Dow Jones (or Dow) is an index of 30 major stocks whereas S&P-500 is a more broad-based index that tracks the top 500 of the most capitalized publicly traded U.S. stocks. |

|

|

A firm's balance sheet gives us the information we need to compute its price/earnings ratio. |

|

|

Current ratio is the ratio of current assets to current liabilities. |

|

|

"Federal Reserve Bank" is the U.S. central bank that determines the U.S. fiscal policy. |

|

Multiple-Choice Questions |

|

Employment statistics at the U.S. bureau of labor statistics website http://www.bls.gov. | |||

| Occupational outlook or training/education needed, expected job prospects etc. for teachers, lawyers, nurses etc. at the BLS website http://www.bls.gov. | ||||

|

Finance statistics at

http://finance.yahoo.com. |

|

|

|

The balance sheet that shows the financial position of a business at a given point in time. |

|

|

The assets that a firm owns always equal liabilities and the owners’ equity. |

|

|

The income statement

lists all sales or revenues and expenses, during a period of time, the

bottom line of which is the net income. |

|

indicates

the firm’s liquidity by measuring the

ratio of current assets to current liabilities. |

|||

|

is the ratio of a

firm’s price to annual earnings and indicates if a firm’s stock is overpriced or underpriced. |

|

|

serves as an excellent accounting

measure because it lets us understand how much debt a firm can carry

without having to declare bankruptcy. |

|

|

||||

|

|

the stock market gives the same high returns all the time. | ||||

|

|

the total returns on the S&P-500

index are unlikely to be negative if you hold it for at least 10 years. |

|

|||

|

|

10-year treasuries have always given

better returns than the market. |

||||

|

|||||

|

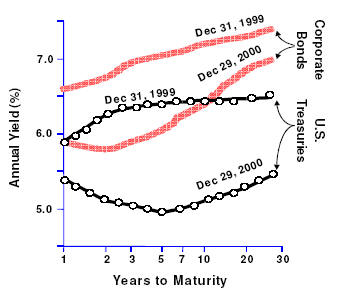

The treasuries show an inversion of

the yield curve that occurred sometime between December 1999 and December 2000. |

|||||

|

|

Corporate bonds yield poorer returns than the U.S. treasuries because investors are more likely to have the confidence in U.S. treasuries than in the corporate bonds. | ||||

| The yield curves for corporate bonds slope upwards because lenders’ expected higher yields for the longer maturities. | |||||

Short notes

Write 150-200 words long answers, with sketches and

illustrations,

as and when appropriate and explaining the underlying concepts in detail.

|

|

||

|

|

|

The news this Monday (December 7,

2008), that Tribune Co. ─ owner of the Los Angeles Times, Chicago

Tribune, Baltimore Sun and other dailies ─ filed for Chapter 11

bankruptcy. Chapter 11 would buy the Tribune Co. time to put its

finances in order. Analysts said the company will almost certainly have

to sell off some of its major holdings ─ and that could prove extremely

difficult because of the bad economy and the poor outlook for

newspapers. In filing for bankruptcy, the company reported $13 billion

in debt and $7.6 billion in assets. To generate cash ─ and meet the next

principal payment of $593 million, due in June ─ Tribune has been

looking to sell the Cubs, Chicago's Wrigley Field and the company's 25

percent stake in a regional sports cable channel. But a tight credit

market has made it tougher for potential buyers to obtain loans. "So,

how did we get here? It has been, to say the least, the perfect storm,"

Zell, chairman and chief executive, wrote in a memo to employees. "A

precipitous decline in revenue and a tough economy have coupled with a

credit crisis, making it extremely difficult to support our debt. All of

our major advertising categories have been dramatically impacted."

|

Home | My Book | Physical Geol: Geol-101, Geol-111 | Environmental Geol: Geol-102, Geol-112 | Oceanography: Ocean-115, Ocean-116 | Business Administration-101

This site was last updated on 05/05/15